How to Create a Forecast Report for Your Business

No matter if you’re killing it in real estate or running a successful coffee shop, it’s important to create a forecast report for your company. Forecast reports have many uses and are a valuable tool to improve the efficiency and effectiveness of your business. In this article, we will discuss the importance of forecast reports and how to create these important reports for your business.

What Is A Forecast Report?

Forecast reports are financial reports used by many real estate businesses that are used to project future revenues and expenses.

For example, suppose you own a brokerage and are thinking of expanding by adding another office or hiring another realtor. One of the first things you should do is create a forecast report of the additional expenses and revenues involved with expansion.

This report will give you a concrete idea of whether expansion is economically feasible, and can help you make a decision based on data.

Importance of Forecast Reports

Forecast reports are important to give businesses a metric to compare actual performance against forecast performance.

For example, suppose you run a coffee shop with multiple locations. Each location has several years worth of revenue data available and you can provide some bonuses based on performance.

In this situation, you can create a forecast report of how much revenue each location is projected to make in the upcoming year and how much of a bonus pool you will need to have at the end of the year.

Another common example involves the purchases of equipment or supplies. In the above example, suppose you are trying to decide if you can afford to purchase new espresso machines for each of your locations. A forecast report that has revenue estimates for the upcoming year can help you divide if purchasing the machines should be done.

For example, suppose you run a brokerage that employs several realtors. Each realtor has several years worth of revenue data available, and you give bonuses based on performance.

In this situation, you can create a forecast report of how much revenue each realtor is projected to make in the upcoming year and how much of a bonus pool you will need to have at the end of the year.

Another common example involves purchases of equipment or supplies. In the above example, suppose you are trying to decide if you can afford to purchase new laptops for each of your realtors. A forecast report that has revenue estimates for the upcoming year can help you decide if purchasing the laptops should be done.

How Do I Create a Forecast Report?

The process to create a forecast report may sound complicated, but there are simple ways to create the report that can then be added to.

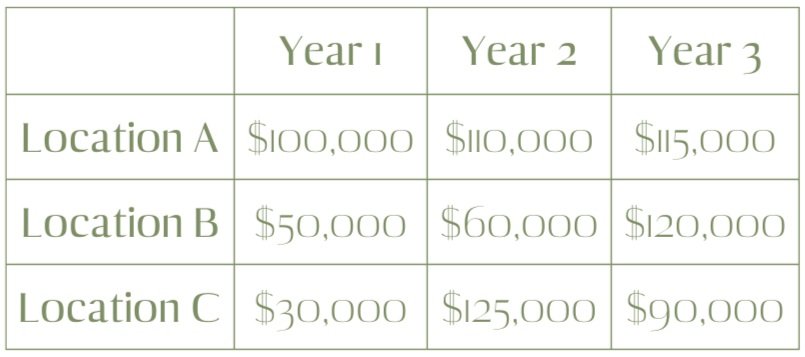

The simplest way to create a forecast report for your coffee shop business is to use data that your company already has. For example, suppose your coffee shop business has 3 locations. Let’s look at a chart of the last three years of revenue for each location:

The simplest way to create a forecast report for your brokerage is to use data that your company already has. For example, suppose your real estate company employs three realtors that produce revenues. Let’s look at a chart of the last three years of revenue for each realtor:

You can see from the above chart that each locations’s revenues change from year to year. One way to forecast each location’s year 4 revenue is to take an average of the last three years and use that as a projection. This can then be adjusted higher or lower by 10% based on perceived market conditions.

What we have just created is known as the sales forecast. The sales forecast is the starting point for other important forecasts, such as the cash collections forecast.

You May Also Like:

What's Your Profit Margin & How to Compare it With Your Industry

Cash Collections Forecast

The cash collections forecast is another extremely important tool to have for your real estate business. Many companies perform services on credit instead of 100% cash. The amount of sales on credit then becomes an account receivable.

Companies then collect on their accounts receivable over the coming weeks or months. Creating a cash collections forecast for the amount of cash you anticipate collecting helps give you an accurate estimate of the amount of cash your company will have at different time periods. This helps planning with meeting expenses such as payroll and rent.

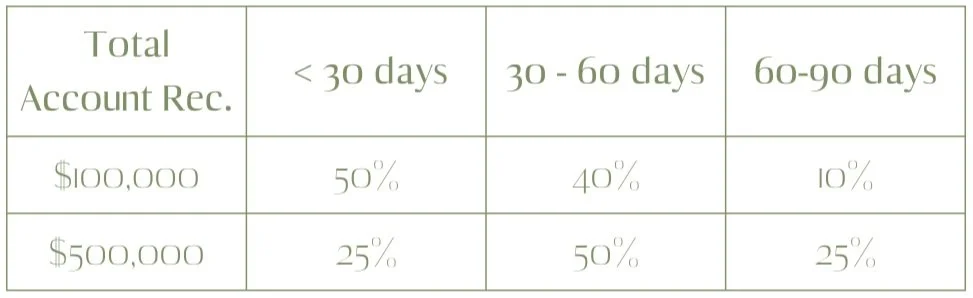

Let’s look at a sample cash collections forecast:

In the above example, you anticipate receiving a total of $225,000 in cash collections for the two accounts receivable listed above. Similarly, in the second month, you expect $290,000 in cash collections.

Without a set forecast of cash collections, it can become difficult to budget properly for monthly expenses.

Variance Analysis

Another important reason to create a forecast report is the ability to perform variance analysis. Variance analysis may sound complicated, but the concept is fairly easy to understand.

For example, suppose your forecast calls for revenue in the first quarter of $1,000,000, but the actual revenue comes in at $800,000. By having a forecast already in place, you can look at different areas of the business that may be responsible for the reduction in revenue.

Performing variance analysis allows businesses to eliminate unprofitable product lines, bring costs in line, and focus on higher margin aspects of the business.

We hope this short discussion helps you create a forecast report, and some ways they can be utilized. If you are interested in more detail of forecasts and additional tools to help improve business performance, check out the rest of the Tatum Accounting website!